18

AÑOS DE

EXPERIENCIA

SERVICIOS

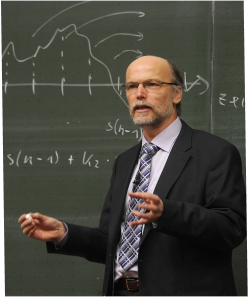

Brindamos una educación de calidad

Para lograr que los estudiantes sean críticos, reflexivos, competitivos e innovadores, capaces de solucionar problemas para mejorar su calidad de vida y transformar su entorno social.

- Plana docente selecta Nivel Preuniversitario

- Cursos de acuerdo al prospecto de Admisión

- Sistema Tutorial, orientación psicológica y Vocacional

- Escuela de padres y muchos más

- Sala de proyecciones y medios audiovisuales

- Exámenes permanentes tipo admisión

- Reforzamientos, repaso, nivelación y preparatoria